Latitude Financial Services

Enhancing the ‘proof of income’ experience

Uplifting NPS from 10 to 38,

Increasing submission rates from 17 to 49%

Background

In 2021, the NZ CCCFA introduced responsible lending requirements to protect credit applicants from future financial difficulties. These requirements include the need for applicants to provide proof of income (POI), such as bank statements or relevant documents, to support application decisioning.

To facilitate digital sharing of bank statements, a third-party service called Proviso was proposed as a solution for the NZ Gem Visa product application, which had already been implemented in Australia.

There was a significant drop-out rate at the POI stage in this existing experience, with unclear reasons for abandonment. Various assumptions were made within the business teams, including the lack of a clear alternative for applicants who preferred not to use (or unable to use) the Proviso method.

To improve the POI user experience, reduce abandonments, and minimise related application referrals, we conducted research to gain insights into how customers expect to provide proof of income and their overall experience with the process. This research aimed to inform refinements and enhancements to the POI UX.

Objectives

To understand participants sentiments to sharing their banking data,

To understand participants response to using Proviso and sharing their banking credentials,

To understand participants preferred method of proving their income and why,

To identify the features and information new users may need to complete the POI task.

Our objectives were driven by a couple of hypotheses:

Hypothesis A

We believe that by offering an alternative flow with a clear choice of POI method up front, we will increase the conversion of the POI task.

Hypothesis B

We believe that by changing the UI presentation we could improve the perception and confidence in the security of the Proviso method.

What would success look like?

Participants not wanting to use Proviso, or able to, choose to continue the application using an alternative POI method to prove their income.

Research

Methodology

10 X 60 minute moderated research sessions online, with a mix of participants, either existing Gem Visa customers or non Gem Visa applicants.

Research activities:

User interviews, and

Test a prototype application flow that;

Presented a clear choice of methods to prove their income,

Including 2 alternative journey’s - Upload payslips and Upload other documents, and,

Featured improved content around trust and security of the Proviso method

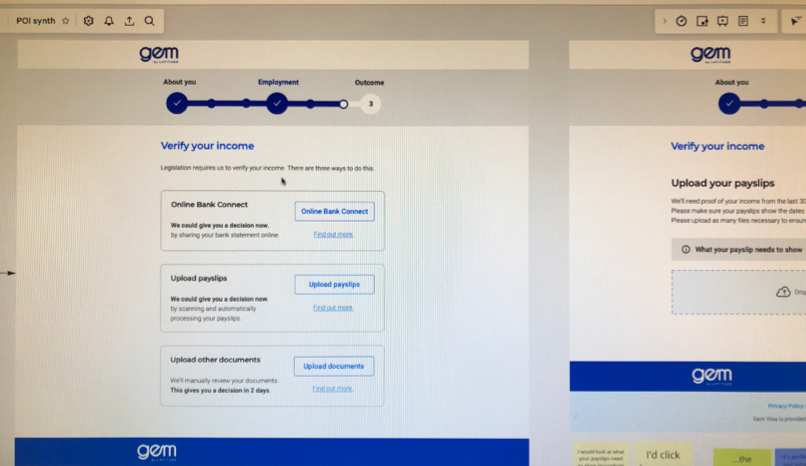

Prototype UI screen flows offering choice of POI.

Choice of POI wireframe screen included for testing the prototype flow.

Findings

Synthesis of findings

Sessions were recorded and verbatim comments collated on a Miro board for theming. In addition to grouping theme by theme, I also created a second view, grouping them chronologically alongside the UI screens they were shown. This view provided visual context to the the UI flow familiar to the delivery team.

Colour coded participant comments for traceability.

Themed comments revealed weight to any collective issues.

Comments mapped to UI flow for easy context for the team.

None of the participants had any issue being asked to share their transactional data.

Those choosing to use Proviso were positive about the service, saying it was easy and seamless. Familiarity from previous experience drove confidence and their expectations were met.

Recognising a trusted brand was an important factor, along with the ease and convenience of not having to switch applications to complete application were reasons given to use this method.

Those choosing to upload payslips stated a variety of reasons why they wouldn’t use the Proviso method:

Didn’t want to share their entire bank statement transactions,

Didn’t trust or have confidence in the security of the service,

Preferred to use payslips, as felt it was easier for them,

Couldn’t remember their banking password,

Didn’t want to break their banks terms and conditions (using credentials anywhere else other than their bank),

What was important to customers:

Choice of POI

Customers wanted control and choice when providing information.Trust in service

There were questions and hesitancy when being asked to use Proviso to prove their income.Flexibility (based on customer circumstances)

Some wanted to know how POI would work for their irregular income.Transparency and security

Helping customer understand up-front how we intend to securely capture their information and why we need it to support their application.

Recommendations

The key recommendation was to include a choice of POI and not limit this to sharing transaction data. Others included;

Promote trust and confidence

Clarify copy and content to reinforce security.

Elevate the perception of Proviso and other POI methods as a trustworthy and secure service.

Include content to inform customers on the importance of POI accuracy and how it affects their application.

Create more flexible user flows. Allow customers to go back and use alternative POI methods for customers not comfortable using their banking credentials with a third party.

Provide guidance at he start of the form to help customers understand how we securely use and store their data.

Outcome

We introduced a choice of POI screen within the flow along with a number of the recommended UI enhancements.

The percentage drop out rate of the POI section for the NZ was reduced in comparison with the equivalent Australian product application flow.

These updates contributed to:

an increase in submission rate from 17% to 49%, and

an NPS score increase from 10 to 38.

The POI choice screen in production.